Ananlisis Ratio Keuangan

Data - data ini di ambil dari Laporan keuangan Pt . Indofood tahun 2012

1. Ratio Likuiditas

- Current Ratio = Harta

Lancar / Hutang lancar

=

59.324.207 / 13.080.544

=

4,54 (4,54 x 100% = 454 % atau 4,5 x)

- Quick Ratio = ( Harta Lancar – persediaan ) / Hutang lancar

=

(59.324.207 – 7.782.594) / 13.080.544

=

51.541.613 / 13.080.544

=

3,94 (3,94 x 100 % = 394 % atau 3,9 x)

=

13.343.028 / 13.080.544

=

1,02 (1,02 x 100 % = 102 % atau 1,2 x)

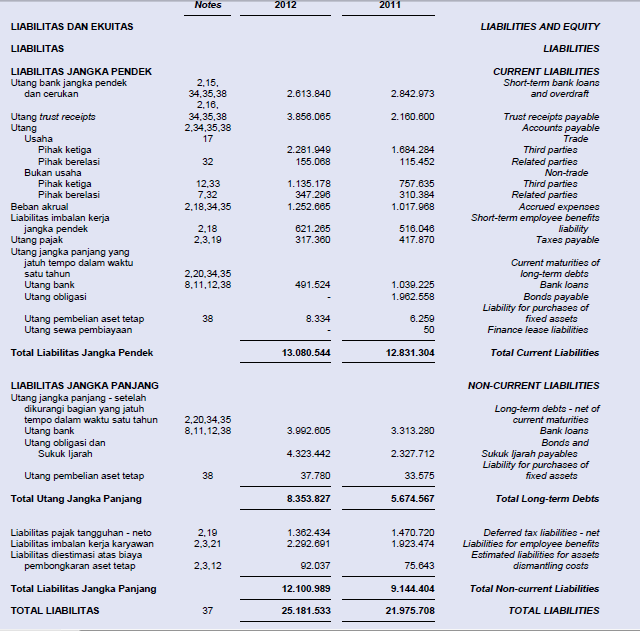

2. Rasio Laverage

- Total debt to equity ratio

=

(hutang lancar + hutang Jgk. Panjang) /Modal

= (13.080.544 +

8.353.827) / 34.142.674

= 21.434.371 / 34.142.674

= 0,63 ( 0,63 x 100 % = 63 % atau 0,6 x)

- Long term dept to equity ratio

=

hutang jk. Panjang / modal

=

8.353.827 / 34.142.674

=

0,24 ( 0,24 x 100 % = 24 % atau 0,24 x)

-Time interest earned ratio

=

EBIT / bunga

=

6.309.756 / 926.590

=

6,81 atau 7 X

-

Debt to total assets ratio

= total hutang / total harta

= 25.181.533 / 59.324.207

= 0,424 ( 0,424 x 100 % = 42,4%)

3. Rasio aktivitas

- Total assets turn over

= penjualan / total harta

= 50.059.427 / 59.324.207

= 0,843 atau hampir 1 x

- Fixed assets turn over

= penjualan / harta tetap

= 50.059.427 /33.121.235

= 1,51 atau 1 kali

- Average collection period

= (piutang / penjualan) x 360

hari

= (3.617.741 / 50.059.427 ) x

360

= 0.072 x 360

= 25,2 hari

- Inventory

turn over = hpp /

persediaan

=

36.493.332 / 7.782.594

=

4,7 ( 5 kali )

- Working

capital turn over

=

(penjualan – hpp) / penjualan

=(

50.059.427 - 36.493.332) / 50.059.427

=

13.566.095 / 50.059.427

=

0,28 X

- Receivable turn over = penjualan / piutang

= 50.059.427 / 3.617.741

=

13,9 X

4. Ratio profibilitas

- Gross profit margin

= laba kotor / penjualan

=

13.566.095 / 50.059.427

=

0,271 atau 27,1 %

- Profit margin

= laba

bersih / penjualan

=

4.871.745 / 50.059.427

=

0,097 atau 9,7 %

- Operating profit margin

=

EBIT / penjualan

=

6.870.594 / 50.059.427

=0,137

Atau 13,7 %

- Earning power

= persediaan / penjualan

= 7.782.594 / 50.059.427

=

0,155 Atau 15,5 %

Mohon maaf Atas kesalahan dalam Melampirkan Tulisan ini.

terimakasih dan semoga bermanfaat bagi yang membacanya

Sumber Laporan www. idx.co.id

Tidak ada komentar:

Posting Komentar